DealStar Highlights

Using your company’s acquisition criteria, DealStar’s acquisition search process conducts exhaustive market research, identifies targets, creates custom and personalized marketing materials for owners, performs personalized outreach, introduces you directly to interested targeted company Owners, and facilitates deals to closing. DealStar typically avoids auctions and their competitive pricing. Our methodology is unique, professional, and politely persistent, making the Compelling Inquiry that positions your company as a unique and special Buyer. You are not just another Buyer with a pile of cash but an organization that sellers can work with to achieve their personal and corporate goals while protecting their corporate legacy for their employees, customers, suppliers, and community.

You will be seen by an Owner as a Buyer they must speak with if they are considering selling.

What follows are brief descriptions of selected components of the DealStar Acquisition Search Process. You will note the common-sense approach used and the attention to detail of each of its components. Before choosing a buyside firm, we encourage you to compare our materials side by side with those of our competitors to see firsthand which will best represent you to business owners.

Schedule a brief call with us to explore the full DealStar package or arrange a presentation.

1. Making the Compelling Inquiry

Valufinder’s “Making the Compelling Inquiry” brochure explains the competitive aspects of today’s M&A market and how Valufinder’s DealStar Process successfully addresses each of these challenges in order to give you a competitive advantage over your competition. We clearly explain how using Valufinder’s DealStar Acquisition Search Process will help us successfully find, introduce you to, and close on targeted acquisitions that meet your specific criteria.

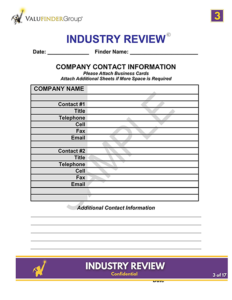

3. Industry Review

The “Industry Review” is a questionnaire that helps a Buyer determine and prioritize the acquisition criteria they want a target to possess. The Buyer, Valufinder’s Senior Vice President of Research, and the DealStar Acquisition Search Team Captain work through this questionnaire together to achieve a clear understanding of the target’s desired characteristics. We then develop a search strategy and identify the various databases, trade directories and search engines to leverage in order to capture the universe of target companies that meet the Buyer’s criteria. This research process results in finding a well-qualified group of targets for the Buyer to consider.

6. Resumes, Experience, and Sector Teams

Our team of seasoned M&A professionals has facilitated in their careers 650+ transactions worth more than $14+ billion. We have extensive experience facilitating transactions across many industries, ensuring knowledgeable and experienced team members are assigned to your search. Depending on your industry criteria, and the size of your search, an appropriate and highly qualified team is assembled to best execute a successful search.

9. Calling Introduction and Facilitation

One week after mailing your marketing materials, our M&A professionals begin a polite and persistent calling/emailing campaign. When speaking with an Owner we explain who you are, your goals, and answer their questions. If they meet your criteria but are not ready to sell, we hang around the hoop until they are. When an Owner is ready to learn more about the options and benefits of a transaction, we give them the requested information and answer their questions. When the Owner is ready to have an initial call we arrange an introductory conference call between you, the Owner, and ourselves. However, prior to this Introductory call we gather information about the company, the Owner’s motivations, concerns, and goals and share them with you prior to the call in order to have a conversation that is productive for all parties.

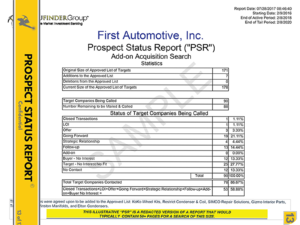

13. Prospect Status Report (“PSR”)

The Prospect Status Report (“PSR”) is a bi-weekly CRM generated report that is emailed to you and your team, keeping everyone informed about the developing progress of each target on the Approved List. We then have a conference call to go over the report in order to answer questions, determine the next steps by whom and by when. The PSR and bi-weekly review process ensures no deals fall through the cracks.